The Chem Ledger #9: Novartis Acquires, LG Chem Partners, Sonichem Expands and More

This week’s roundup of significant deals, strategic investments, key collaborations, and notable startup news.

M&A

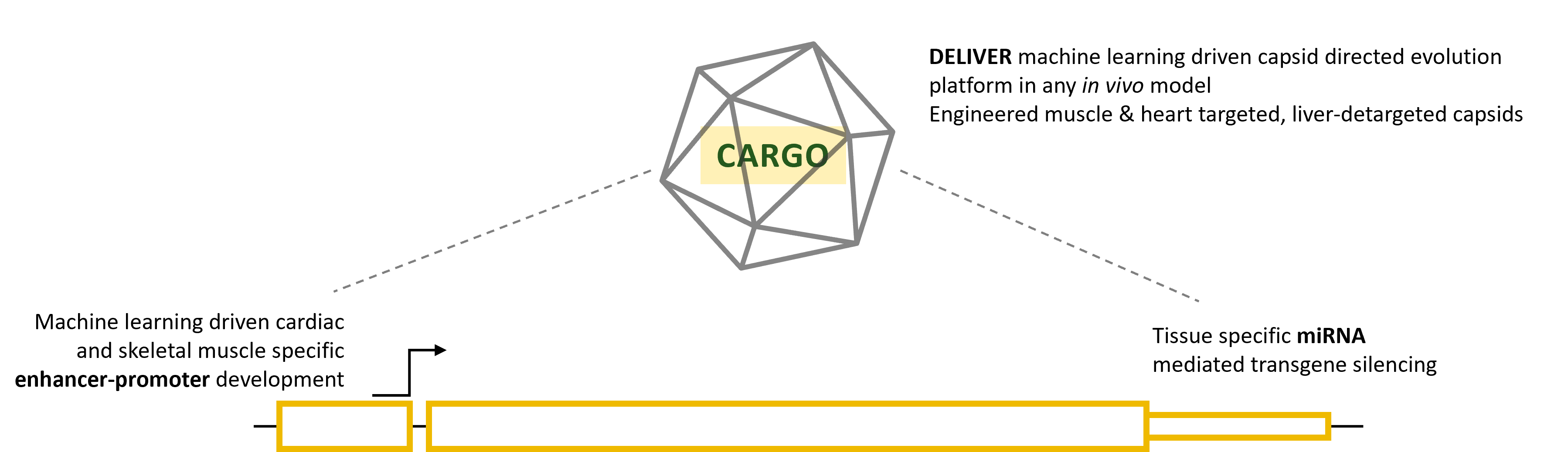

1/ Novartis has acquired San Diego, California-based Kate Therapeutics, which focuses on developing gene therapies for inherited neuromuscular diseases. This acquisition is valued at up to $ 1.1 billion and aims to enhance Novartis's portfolio in gene therapy, particularly targeting conditions such as Duchenne muscular dystrophy (DMD) and facioscapulohumeral dystrophy (FSHD).

2/ Hyosung Chemical announced that it has cancelled the sale of its specialty gas unit to a consortium comprising IMM Private Equity and STIC Investments Inc. The negotiations, which aimed to finalize the sale for 1.3 trillion won (around $1 billion), fell through, highlighting ongoing challenges for Hyosung Chemical, particularly its reliance on major partners like Samsung.

3/ SLR Consulting (Canada) Ltd. has announced the acquisition of Robertson GeoConsultants Inc. (RGC), effective November 1, 2024. This move will enhance SLR's capabilities in the mining sector, as RGC specializes in geotechnical, geochemical, and hydrogeological consulting services specifically for the mining industry.

4/ Protech Group based in Montreal, Quebec, has acquired Caldwell Chemical Coatings, which is located in Fayetteville, Tennessee. This acquisition aims to enhance Protech's presence in the liquid coatings market, particularly in industrial coatings and its position in the international paints and coatings sector.

5/ Longxing Chemical signed an equity acquisition framework agreement to acquire CSRC China Corporation from Csrc Pte Ltd. Longxing is a Chinese company engaged in the production and distribution of chemical products, particularly carbon black, precipitated silica, and polyvinylidene fluoride. This acquisition aims to enhance Longxing's capabilities and market presence in the chemical sector. Additionally, Longxing is also looking to acquire 100% of China National Tire & Rubber Co. (Anshan) and China National Tire & Rubber Co. (Chongqing), a part of its strategic expansion efforts.

6/ Glenwood Private Equity has acquired Techcross Environmental Services Inc., Techcross Water & Energy Inc., and the Chinese subsidiary of Bugok Environment Co. from Bubang Co., Ltd. The total value of this acquisition is approximately $190 million. Glenwood is an alternative investment firm based in Seoul, South Korea, founded in 2014. It specializes in buyout opportunities, particularly focusing on sectors such as energy, gas, and industrials within the South Korean market. As of now, Glenwood manages a cumulative assets under management (AUM) of $3.0 billion.

Investments

1/ Eastman Chemical Company has announced significant investments to upgrade and expand its extrusion capabilities for interlayers at its manufacturing facility in Ghent, Belgium. Eastman specializes in polyvinyl butyral (PVB) interlayers, which are crucial for automotive and architectural glass lamination. These interlayers enhance features such as solar control, sound reduction, and safety.

2/ Altria Investments has significantly increased its stake in Quaker Chemical by 41.1% during the third quarter of 2024. Having purchased an additional 769 shares, they now own a total of 2,641 shares. (Discover the latest investments in Quaker Chemical).

Collaborations

VSParticle aims to combine its technology with self-driving labs and AI to accelerate development and enable cost-effective mass production of materials.

1/ VSParticle, based in Delft, The Netherlands, has collaborated with Meta and the University of Toronto (UofT) to launch the first and largest open-source experimental catalyst database aimed at accelerating the transition to clean energy. This partnership combines VSParticle's expertise in nanoparticle synthesis with Meta's Fundamental AI Research (FAIR) capabilities, and UofT's robust testing platform that supports the experimental validation of new materials.

2/ LG Chem and ExxonMobil have signed a non-binding memorandum of understanding (MoU) for a multi-year offtake agreement concerning lithium carbonate. The agreement involves the supply of up to 100,000 tonnes of lithium carbonate which will be sourced from ExxonMobil's project in Arkansas, USA. This partnership reflects a growing trend among energy and EV companies to secure supplies of critical minerals as the transition to renewable energy and electric vehicles accelerates.

3/ Avantium, a Netherlands-based leader in renewable chemistry, and SCGC (SCG Chemicals Public Company Limited), a major petrochemical company headquartered in Thailand, have formed a strategic partnership aimed at advancing sustainable polymer production, particularly focusing on the development of PLGA (polylactic-co-glycolic acid), using CO2 as the feedstock. The two companies are working together to pilot the production of PLGA with an estimated capacity of 10 tonnes per annum.

4/ Neste and PCS Pte. Ltd. have formed a partnership aimed at introducing renewable solutions to Southeast Asia's chemicals industry. Neste will provide renewable feedstocks, specifically its renewable Neste RE to PCS in Singapore. PCS is a significant player in the essential chemicals sector, operating within the S$5.4 billion Singapore Essential Chemicals Complex located on Jurong Island.

Startups

1/ Sonichem, a UK-based clean technology company, specializes in the conversion of low-value forestry by-products such as sawdust into high-value biochemicals. Sonichem is planning to open its first commercial plant in Scotland by 2027, with a capacity to process up to 15,000 tonnes of forestry material annually. Sonichem rebranded from its previous name, Bio-Sep, effective immediately as of December 3, 2023. This rebranding reflects the company's focus on sustainable production processes using ultrasonic technology.

2/ IonKraft GmbH, a startup based in Germany, has secured €3.5 million in equity funding. This funding round, which closed on November 18, 2024, was co-led by M Ventures, the strategic investment fund of Merck KGaA, and TechVision Fund, with participation from High-Tech Gründerfonds. The capital will be utilized to enhance the production and sales of IonKraft's coating machines, which are designed to support the circular economy in packaging.

3/ Faircraft, a Paris-based startup specializing in lab-grown leather, has raised $15.8 million in a recent funding round backed by several prominent investors, including Kindred Ventures, Cap Horn, and BPI. This capital will be utilized to expand their team and accelerate the development of their lab-grown leather products, which utilize patented tissue engineering techniques.

If you’d like to receive these weekly updates directly in your inbox, please enter your email below. Stay informed and ahead with the latest developments in the chemical and materials industries, delivered right to your inbox.

Discover more about me here.