TCL #42: The Funding Flow

From geothermal grids to plastic purification, venture capital finds new frontiers in industrial innovation

Capital continues to chase solutions to the world's most pressing industrial challenges, as this week's funding rounds demonstrate. Investors are backing technologies that promise to reshape everything from energy generation to waste management, with particular enthusiasm for processes that can extract value from what was once considered refuse. Whether it is Utah-based Rodatherm's geothermal systems or Honda's near-perfect plastic purification technology, the common thread is efficiency. Yet regulatory headwinds remind us that innovation alone is insufficient, as ExxonMobil's abandoned European recycling plans show, the rules of the game matter as much as the technology itself. And across the Channel, Britain watches helplessly as pharmaceutical titans like AstraZeneca fold their financial wings and fly elsewhere, leaving behind only the bitter taste of investment opportunities squandered on the altar of political short-sightedness.

Energy

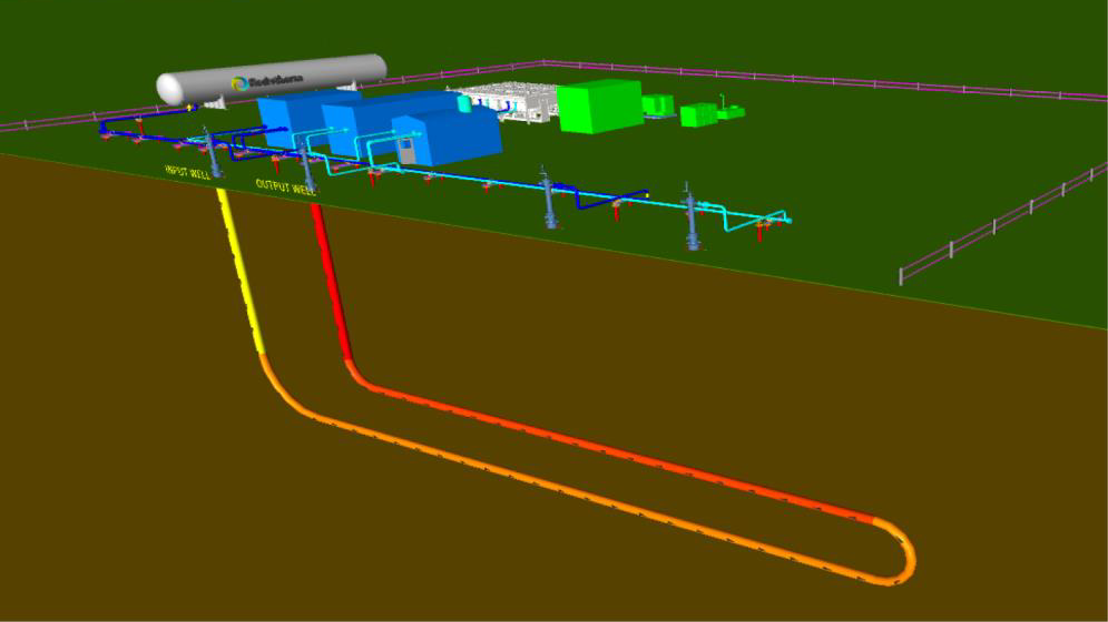

Rodatherm Energy Corporation, a geothermal startup based in Utah, has secured $38 million in a Series A funding round. The company, founded in 2021, primarily operates in the Great Basin region of the Western United States. The funding will support the pilot deployment of their geothermal energy technology, which aims to be more efficient and use less water than traditional methods by utilizing refrigerants in a closed-loop system. The company plans to build its first pilot system in Utah.

Recycling

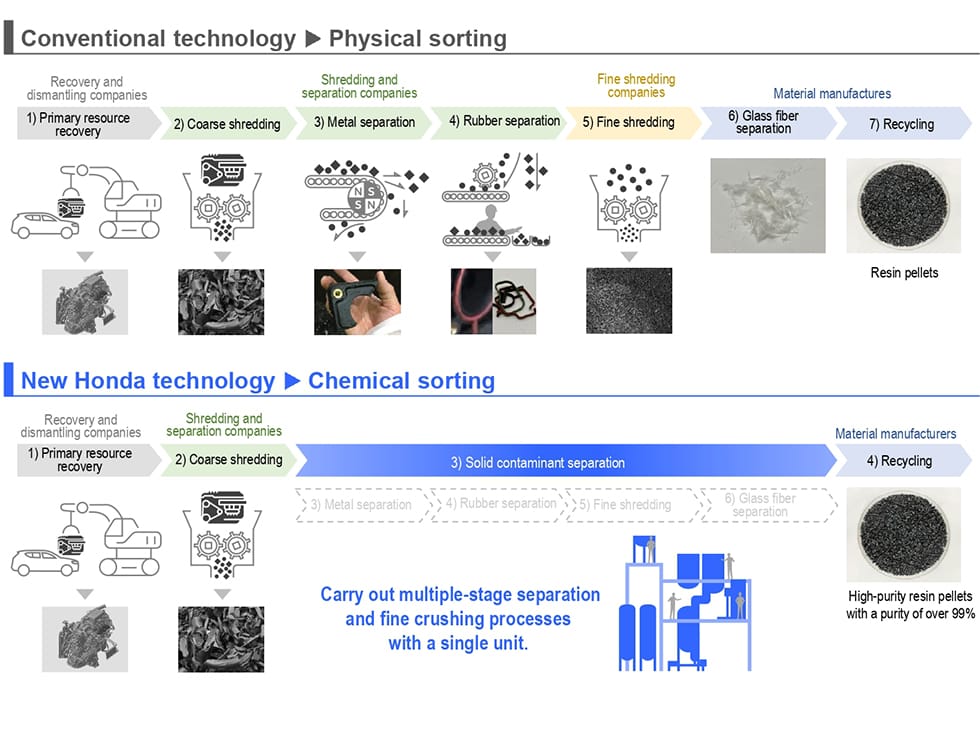

- Honda has developed a new chemical sorting technology designed to extract high-purity plastics from end-of-life vehicles (ELVs). The chemical sorting technology dissolves the resin in a solvent, allowing for the removal of solid contaminants, such as metal. Rubber, glass fiber etc., and the extraction of high-purity resin. The process has achieved a solid contaminant separation rate of over 99%, which is an improvement from 80% in the older process. Moreover, the purity of recovered plastics exceeds 99%. To put this technology into effect, Honda will build a pilot facility with a maximum processing capacity of 350 tons per year. Technology will be verified by the end of 2026 with an aim for practical application by around 2029.

- ExxonMobil has halted its $118 million chemical recycling plans in Europe, specifically at its sites in Antwerp, Belgium, and Rotterdam, Netherlands. The decision is attributed to the European Union's draft rules on mass balance, which the company believes unfairly discriminates against integrated petrochemical sites. The draft law calculates recycled content based on the mass of waste input and output, which ExxonMobil claims penalizes complex integrated facilities that co-process plastic waste with virgin materials.

Pharma

- Bristol Myers Squibb (BMS) has signed an agreement to sell its controlling stake of 60% in its US-China joint venture, Sino-American Shanghai Squibb Pharmaceuticals (SASS). The joint venture was established in 1982 between BMS and China's Sinopharm Foreign Trade, making it the first US-China pharmaceutical joint venture.

- AstraZeneca has paused a planned investment of £200 million (~$271 million) into its research site in Cambridge, UK. The decision is part of a broader trend of major drugmakers cancelling planned investments in the U.K. due to an unfavorable commercial environment. U.S. pharmaceutical giant Merck also discontinued plans for a new research center in London, citing a lack of investment in the life-science industry and undervaluation of innovative medicines by U.K. governments.

Biotech

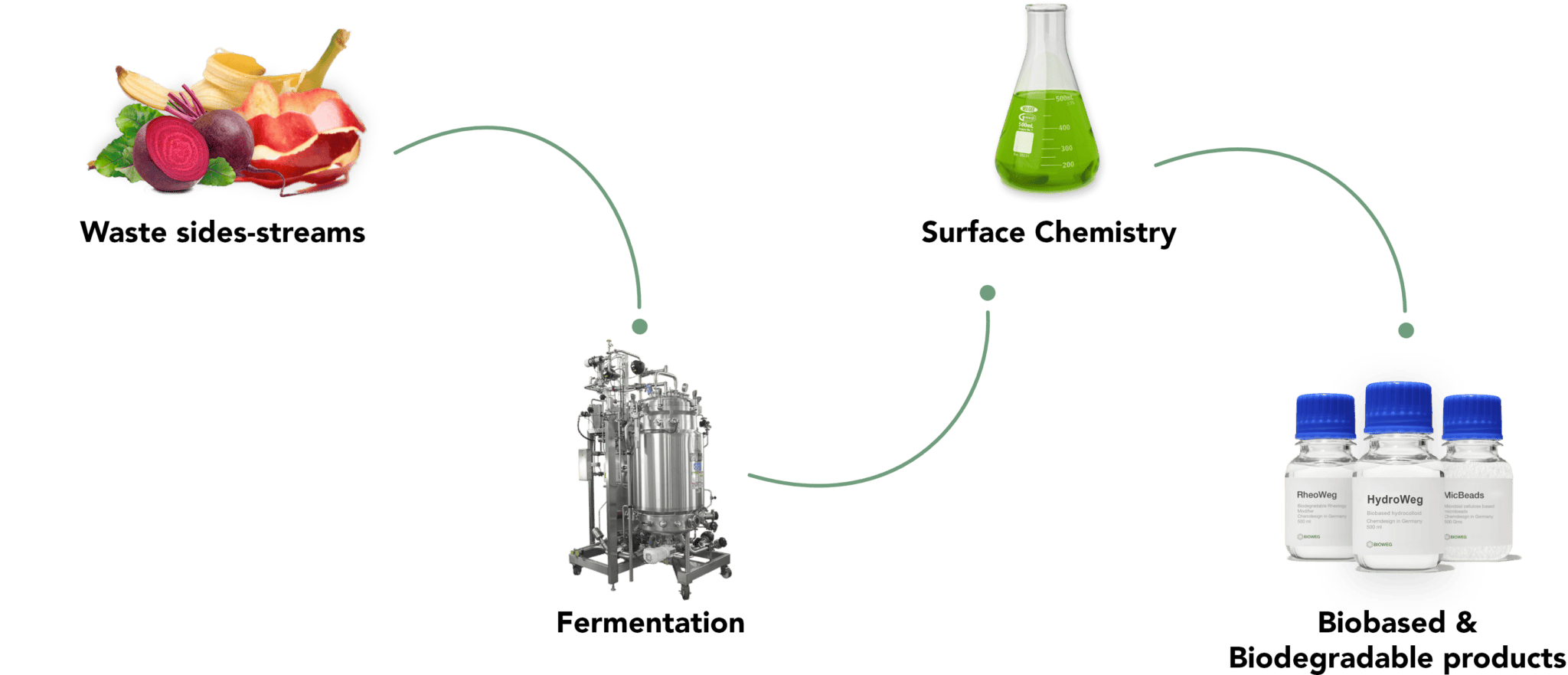

- BIOWEG has secured €16 million (~$18.8 million) in Series A funding. This capital will be used to support the construction of their first industrial bacterial cellulose plant in Germany, scale up their operations, and accelerate market entry across Europe. BIOWEG develops high-performance, biodegradable ingredients as alternatives to microplastics, utilizing precision fermentation to convert food industry side streams into bacterial cellulose.

- Genomines, a French biotech company, has raised $45 million in Series A funding to develop a bio-based alternative to traditional nickel mining. The company uses phytoextraction, a process that employs hyperaccumulator plants to absorb heavy metals from the soil. Genomines is exploring proof-of-concept projects with automakers like Hyundai Motor Group and Jaguar Land Rover, as well as battery manufacturers. The new funding will support more field tests and help establish offtake agreements with partners.

Life Sciences

Lila Sciences has raised $235 million in Series A funding. This funding round was co-led by Braidwell and Collective Global. The company is developing an end-to-end platform that unifies AI, software, and robotics to autonomously drive the scientific method across diverse fields. Earlier this year, the company also raised $200 million in seed funding.