TCL #39: Activists Target Chemical Giants

From carbon conversion to corporate raiders, the chemical sector seeks new formulas for growth

OCOchem is turning carbon dioxide waste into valuable chemicals, while Group14 Technologies raised $463 million to expand silicon battery production across two continents. Meanwhile, activist investors are circling Avantor and AkzoNobel, demanding operational overhauls as companies grapple with everything from mining deals gone wrong to new drug approvals that could reshape entire markets.

CO2 Conversion & Utilization

OCOchem, a clean‑tech startup founded in 2017 in the Pacific Northwest, has teamed up with ADM to develop a new carbon‑conversion plant in Decatur, Illinois. The facility, to be built at one of ADM’s existing sites, will employ OCOchem’s Carbon FluX Electrolyzer technology to transform carbon dioxide generated during ethanol production into formate molecules for both consumer and industrial use. OCOchem’s research activity is centred in Richland, Washington. ADM, originally Archer‑Daniels‑Midland, remains headquartered in Chicago, and is a heavyweight in agricultural processing and nutrition, serving markets for both people and livestock.

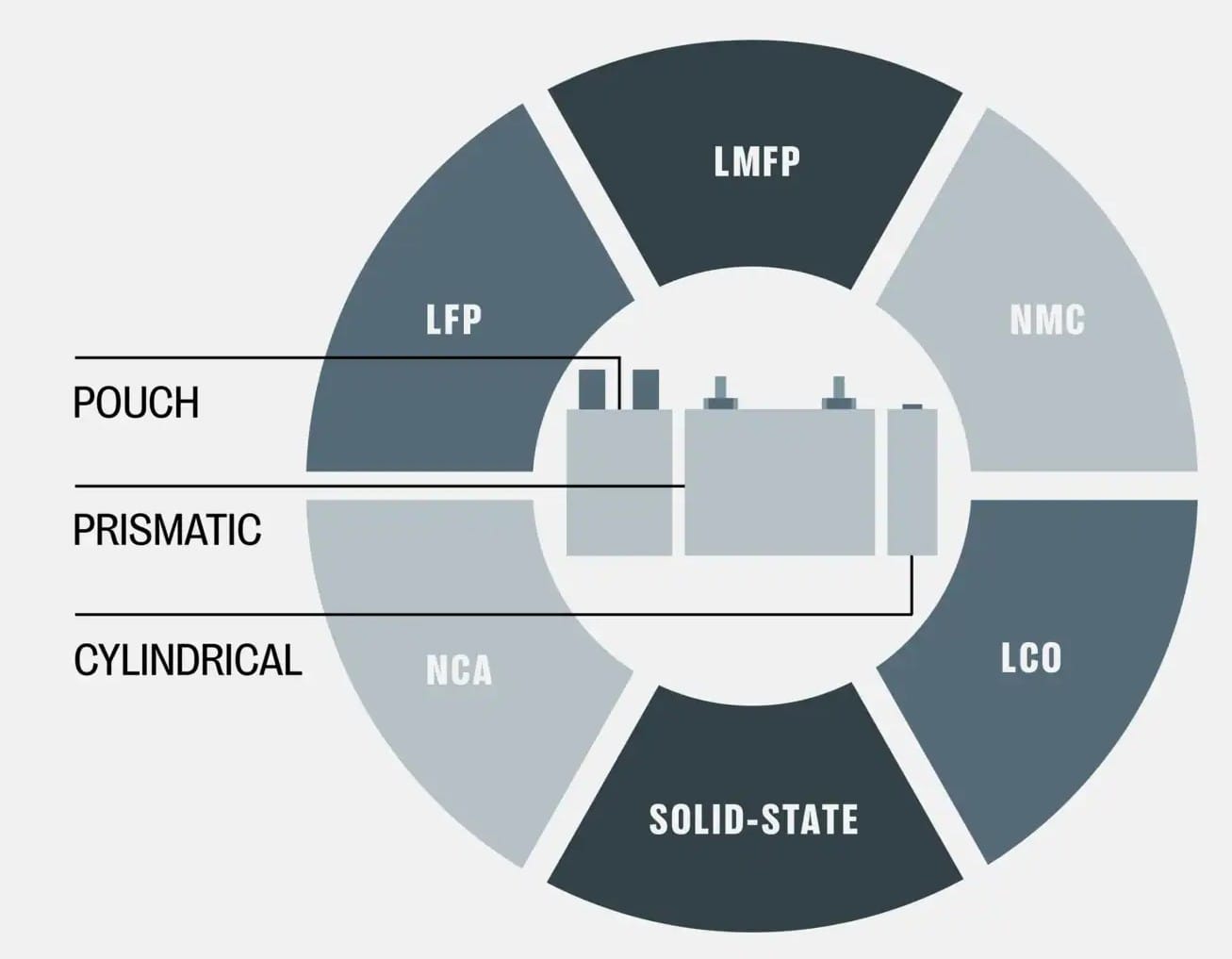

Battery

Group14 Technologies, a Seattle-based maker of silicon-battery materials, has raised $463 million in a Series D round led by South Korea’s SK Inc. The money will fund expansion of production for its silicon anode material, SCC55, in both America and South Korea. The firm has also assumed full control of its Korean operations, buying out SK’s prior joint-venture stake. Clean-energy ventures in the United States are grappling with shifting tariffs, unpredictable tax treatment and shrinking subsidies, which have clouded investment and job prospects. For firms with global ambitions, that policy volatility makes building capacity abroad a hedge against Washington’s wavering.

Energy

Aalo Atomics has raised $100 million in Series B financing to construct its first nuclear power reactor, Aalo‑X, with the firm targeting zero‑power criticality by next summer. Adjacent to the plant, it plans to build an experimental data centre, the first known attempt to co‑locate nuclear generation and digital infrastructure. The move signals Aalo’s bet on the surging electricity demands of artificial‑intelligence models, and its ambition to position nuclear energy as the backbone of data‑hungry computing.

Marine Fuel

Mitsui O.S.K. Lines (MOL) and ITOCHU have struck a joint development deal to pioneer ammonia bunkering and ammonia-powered vessels, positioning themselves at the forefront of shipping’s low-emission future. The move aligns with the International Maritime Organization’s target to achieve net-zero emissions by 2050. In June 2025, ITOCHU ordered the world’s first 5,000 m³ ammonia bunkering vessel, due in 2027 under the Singapore flag. Meanwhile, MOL will co-own three ammonia dual-fuel Capesize bulkers with Belgian firm CMB. TECH NV, set for delivery between 2026 and 2027. Together, they plan ship-to-ship ammonia refueling trials in Singapore in late 2027.

Life Sciences

Activist investor Engine Capital has acquired a roughly 3% stake in Avantor and is pressing the life-sciences supplier to either undertake sweeping operational reforms or consider a sale. Avantor, headquartered in Radnor, Pennsylvania, provides laboratory equipment and consumables to clients in the life sciences sector and beyond. The company currently holds a market capitalization near $9 billion, following a near 40% slide in its share price this year. Engine Capital’s intervention comes amid criticism of Avantor's leadership and capital allocation decisions, with calls for a portfolio overhaul, cost-cutting measures, and a refreshed board. The activist also suggests that if internal improvements falter, a strategic sale could unlock shareholder value.

Specialty Chemicals

Chemours, an American chemicals giant, has struck a bargain with SRF Limited, an Indian conglomerate, that exemplifies modern supply-chain pragmatism. Rather than sink capital into new facilities in the subcontinent, Chemours will piggyback on SRF's existing manufacturing prowess to produce fluoropolymers and fluoroelastomers, specialty chemicals essential for semiconductors, aerospace, and automotive applications.

Oil & Gas

Cenovus Energy is acquiring MEG Energy for C$7.9 billion (~ $6 billion) in a cash-and-stock deal that will create a combined oil producer pumping 720,000 barrels per day. MEG shareholders will receive C$27.25 per share (75% cash, 25% Cenovus stock), which is a 33% premium. The deal expected to close in Q4 2025 and generate C$400 million in annual synergies by 2028.

Mining

Peabody Energy has abandoned its $3.78 billion acquisition of Anglo American's Australian steelmaking coal assets, a move that signals a significant disruption to the latter's strategic restructuring. The deal, initially agreed upon in November 2024, collapsed following a fire at the Moranbah North mine in March. Despite extensive negotiations, Peabody and Anglo American failed to reach a revised agreement that adequately compensated Peabody for the fire's long-term impact on the asset's value and operational capacity. This termination represents a setback for Anglo American's efforts to streamline its portfolio and fend off a potential takeover bid.

Pharma

The U.S. Food and Drug Administration (FDA) approved Novo Nordisk's Wegovy drug for treating metabolic dysfunction-steatohepatitis (MASH), a serious liver ailment. This approval makes Wegovy the first drug in the GLP-1 class, a class originally designed for diabetes, to be authorized for MASH, a condition that plagues an estimated 5% of Americans and can lead to progressive liver damage. Investors cheered the news. The company's shares rose nearly 5% in European trading post the FDA approval. The approval provides welcome relief for Novo Nordisk, which has been grappling with intensifying competition in the lucrative obesity market from rivals like Eli Lilly and a growing army of generic copycats.

Paints & Coatings

Cevan Capital has acquired a 3.02% stake in AkzoNobel, valuing the investment at approximately €294.4 million ($341.7 million). Cevan is an international investment firm that specializes in acquiring significant ownership in European public companies where long-term value can be enhanced through active ownership. AkzoNobel had previously lowered its core profit outlook for 2025 due to market uncertainties and currency drawbacks, but reaffirmed its mid-term guidance for adjusted EBITDA margin and return on investment. For Cevan, the acquisition suggests confidence that AkzoNobel's troubles are temporary.