TCL #38: The Weight of Industrial Realignment

From rare earth funding to abandoned recycling plans.

The industrial landscape shifts with the methodical precision of capital seeking its most productive outlets. While Vulcan Elements secures $65 million to establish rare earth magnet production using exclusively American and allied materials, and technology partnerships proliferate across semiconductors and sustainable textiles, the week also delivers its share of abandoned plans. The companies are positioning themselves for a world where supply chain sovereignty matters as much as profitability, even as quarterly results remind us that the fundamentals of business remain stubbornly unchanged.

Rare Earths

Vulcan Elements, based in Durham, North Carolina, has announced a $65 million Series A funding round. This funding aims to increase the company's production of high-performance rare-earth magnets in the United States. The company was valued at $250 million during this funding round, which was led by Altimeter Capital. Altimeter has backed companies like OpenAI and Uber Technologies. Vulcan opened a pilot manufacturing facility in Durham and has produced initial magnets for military and commercial clients, using only U.S. and allied materials, equipment, and software.

Artificial Intelligence

The U.S. National Science Foundation (NSF) and NVIDIA have partnered to invest a total of $152 million in artificial intelligence (AI) to enhance scientific research capabilities in the United States. This initiative aims to develop a suite of fully open AI models that will advance how American scientists utilize AI for discovery, with initial focus on materials science, biomedical advancements, and improving large language models.

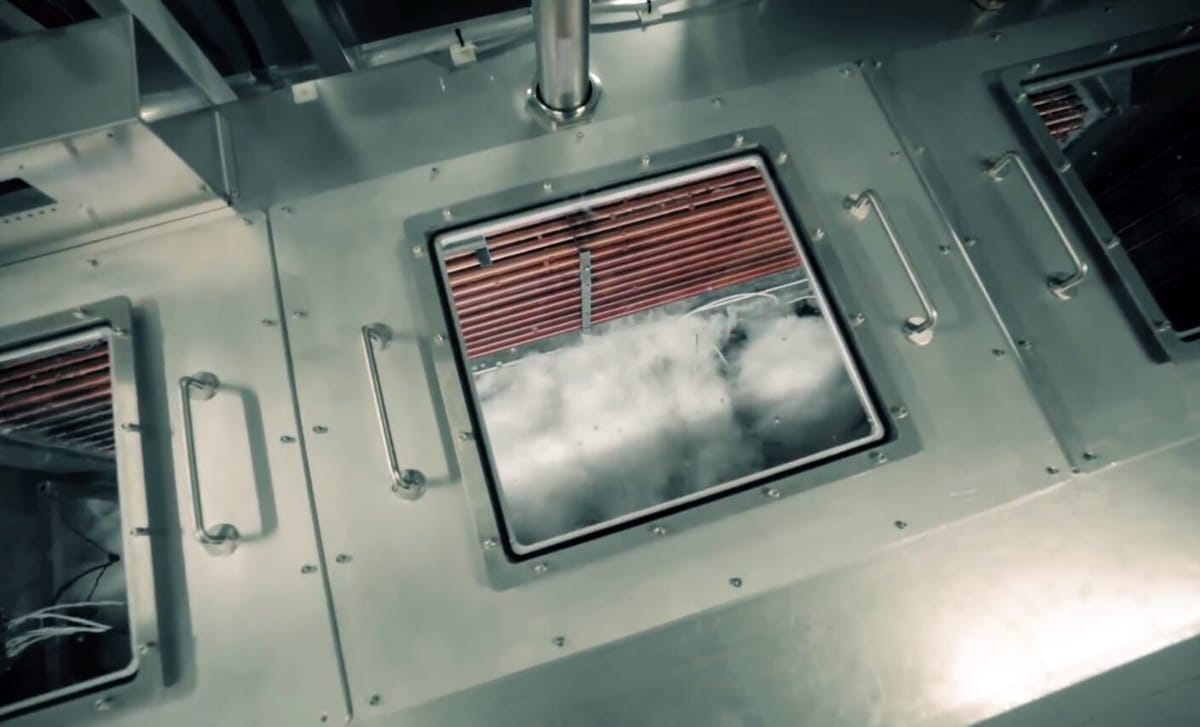

Immersion Cooling

Samsung Electronics has approved Chemours' Opteon two-phase immersion cooling fluid. The approval ensures compatibility and performance with Samsung's current-generation Solid State Devices (SSDs), addressing cooling and energy demands driven by AI and next-generation chips. Opteon is the first two-phase immersion cooling fluid approved by Samsung, with testing for subsequent generations planned in the coming months. The two companies collaborated with LiquidStack, an American immersion cooling tank manufacturer, and PKI Corporation, a Korean company developing and researching liquid cooling technology, to conduct performance testing using a commercial-scale 48U immersion cooling tank.

Coatings and Adhesives

Covestro has signed an agreement with Vencorex Holding SAS to acquire two production companies for HDI (hexamethylene diisocyanate) derivatives. These sites are located in Rayong, Thailand, and Freeport, USA, and were formerly part of the French company Vencorex. Vencorex is a subsidiary of PTT Global Chemical Public Company Limited, a Thai chemical company. This acquisition strengthens Covestro's Coatings & Adhesives production network and its Solutions & Specialties segment.

Textiles

Eastman and Huafon Chemical have formed a strategic partnership to establish a joint manufacturing facility in China for the production of Eastman's Naia cellulose acetate filament yarns. The facility aims to enhance localized production of Naia which is made from sustainably sourced wood pulp and designed to fully disintegrate and biodegrade in the ocean within months. Huafon will combine local advantages with international resources to achieve a fully localized chain from technological innovation to service.

Recycling

Dow and Mura Technology have cancelled plans to build a 120,000 metric tonnes/year chemical recycling facility for mixed plastic scrap at Dow's Böhlen site in Germany. The plan for this facility was initially announced in 2022. This decision follows Dow's announcement to permanently close its steam cracker at Böhlen by the end of 2027. Dow has stated that it is exploring other opportunities to expand its supply portfolio in Europe.

Earnings

- Origin Materials, Inc. reported its financial and operating results for the second quarter of 2025. Revenue was $5.8 million compared to $7.0 million in Q2 2024. This decrease was attributed to the planned wind-down of the supply chain activation program. Operating expenses was $15.1 million, down from $18.5 million in Q2 2024, primarily due to reductions in general and administrative and research and development expenses. Net loss was $12.7 million , an improvement from a $19.5 million net loss in Q2 2024. This improvement was driven by gains in the fair value of warrants and earnout liabilities, and lower operating expenses.

- Stratasys reported its financial results for the second quarter of 2025. Revenue was $138.1 million, a slight increase compared to $138 million in Q2 2024. GAAP Net Loss was $16.7 million, or $0.20 per diluted share, an improvement from a net loss of $25.7 million, or $0.36 per diluted share in Q2 2024. Non-GAAP Net Income was $2.2 million, or $0.03 per diluted share, compared to a non-GAAP net loss of $3.0 million, or $0.04 per diluted share, in Q2 2024. The company reported $254.6 million in cash, equivalents, and short-term deposits, with no debt as of June 30, 2025.

- Celanese Corporation reported its second quarter 2025 financial results. U.S. GAAP diluted earnings per share (EPS) was $1.90 and adjusted EPS was $1.44 which exceeded the forecast by 2.86%. Net Sales was $2.5 billion, a 6% increase from the previous quarter driven by a 4% increase In volume and a 3% increase in currency, with a slight offset in price. Consolidated Operating Profit was $233 million which is a 9% margin.