TCL #37: Silicon Dreams Meet Ceramic Realities

From military-grade materials to electric vehicle pragmatism, industry navigates the turbulent waters of technological transformation.

In the laboratories of Redwood City, artificial intelligence has become the new philosopher's stone, transmuting the ancient art of ceramics into something altogether more extraordinary for DARPA's military ambitions. Meanwhile, across the Pacific, Asahi Kasei's zeolite wizards have conjured biomethane from humble biogas with a purity of 97%, promising commercial magic by 2027. General Motors, ever the pragmatist in this age of electric dreams, has chosen the path of temporary matrimony with China's CATL batteries, a two-year courtship while domestic production learns to walk. Saint-Gobain's acquisition spree reads like a materials science fairy tale, gathering €25 million worth of construction specialists from three continents to build tomorrow's low-carbon castles. Yet behind these triumphs lurk the darker chapters. Chemours bleeding cash in litigation costs, and Rayonier's catastrophic miss that sent earnings plummeting from forecasted pennies to actual dollars lost, a reminder that in the grand bazaar of industrial transformation, not every alchemical experiment turns base metals into gold.

Materials

- Citrine Informatics, based in Redwood City, California, is providing artificial intelligence (AI) for DARPA's INTACT (Intrinsically Tough and Affordable Ceramics Today) program. The aim is to increase dislocation density in ceramics to enhance their fracture toughness. The company will optimize the cold spray process using machine learning models. Cold spray processing aims to achieve high-kinetic-energy impacts for large dislocation densities. The program has applications in defense, including sensing, propulsion, armor, and vehicle structures.

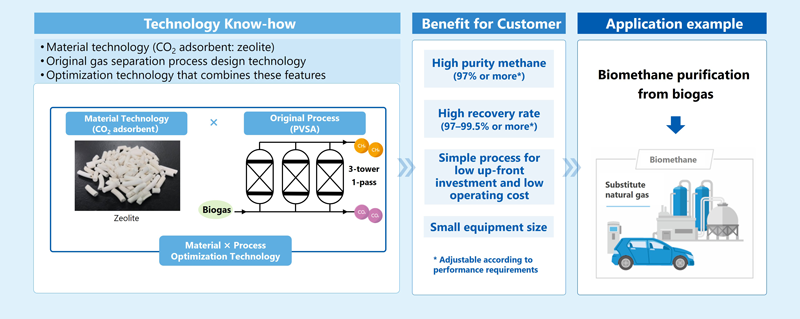

- Asahi Kasei has demonstrated biomethane production using zeolites. The trial began in February 2025 in Kurashiki, Okayama Prefecture, Japan, and achieved a yield of up to 99.5% or more and a purity of 97% or more. The system uses a pressure vacuum swing adsorption (PVSA) process technology and a novel zeolite to separate carbon dioxide and methane from biogas, producing biomethane. The company, having a long track record in catalyst development and gas separation technologies, plans to commercialize the technology in 2027 and has launched global licensing activities.

- Starboard Value LP, an investment advisory company, has acquired over 9% stake in Rogers Corporation. Rogers Corp, with a market value of $1.3 billion, is a specialty engineered materials company headquartered in Chandler, Arizona. The company produces materials for electric and hybrid cars, personal electronics, and industrial applications. Rogers Corp's shares have dropped over 30% this year. Starboard plans to push for changes to boost Rogers Corp's share value.

Battery

General Motors (GM) plans to import CATL-made lithium iron phosphate (LFP) batteries for about two years to power the next-generation Chevrolet Bolt, as a stopgap while GM and LG Energy Solution (LGES) work to produce their own US-made LFP batteries. The Bolt's price is expected to be around $30,000. GM has indicated the economics may be marginally profitable or close to break-even with the temporary CATL supply.

Additive Manufacturing

Toyota is increasing its use of additive manufacturing through a partnership with Stratasys, an American-Israeli manufacturer of 3D printers, software, and materials. Toyota engineers can now create tools, fixtures, and jigs from initial concept to working prototype in just one day. The partnership, spanning over 10 years, provides Toyota with access to industrial-grade 3D printers and high-performance polymers designed for tough factory conditions.

Recycling

Origin Materials and Berlin Packaging have formed a strategic partnership for sustainable PET bottle caps. Berlin Packaging will purchase PET 1881 caps from Origin Materials for distribution to major beverage companies. Origin's PET 1881 caps can be made from 100% post-consumer recycled PET and are designed to improve recyclability and support circular economy goals.

Paints & Coatings

PPG and Asian Paints have renewed their joint venture in India for 15 years. The agreement, effective from 2026, will allow the companies to continue serving customers in the industrial, protective, marine, packaging, automotive, and powder coating sectors. The renewal maintains the existing management and shareholding structures.

Construction

Saint-Gobain has acquired three firms to strengthen its construction chemical platform. The acquired companies are Interstar Materials (North America), Isoltech (Italy), and Soquimc (Peru). Interstar specializes in high-performance pigments for concrete, Isoltech focuses on cellular concrete technology offering lightweight concrete with thermal and acoustic insulation, and Soquimc manufactures concrete admixtures in Peru. The combined revenues of the three acquired companies are €25 million (~ $29 million). The acquisitions are expected to support the development of low-carbon materials and expand Sant-Gobain's market reach.

Pharma

CorMedix Inc., a biopharmaceutical company focused on developing and commercializing therapeutic products for the prevention and treatment of life-threatening diseases and conditions, has acquired Melinta Therapeutics LLC for $300 million. The deal is structured as $260 million in cash and $40 million in CorMedix equity. The acquisition expands CorMedix's product portfolio to include seven marketed infectious disease products and one cardiovascular product, enhancing its presence in acute care settings.

Earnings

- Chemours reported its Q2 2025 results on August 5, 2025. Net sales were $1.6 billion, a 4% increase compared to Q2 2024. Net loss was $381 million, compared to a net income of $60 million in Q2 2024, primarily due to litigation-related charges and tax impacts from a settlement with the State of New Jersey. Adjusted Net Income was $87 million, compared to $58 million in the prior-year quarter.

- Rayonier Advanced Materials Inc. (RYAM) reported its Q2 2025, which ended on June 28, 2025. Net sales were $340 million, a decrease of $79 million compared to Q2 2024. The company posted an EPS of -$5.44, significantly below the forecasted -$0.23. The results were impacted by challenges including tariff volatility, operational disruptions, and non-cash charges.

- Bayer reported Q2 2025 results on August 6, 2025. Group sales reached €10.739 billion (~13 billion). This is a 0.9% increase adjusted for foreign exchange and portfolio changes. Core EPS was €3.72, EBITDA before special items was €2.1 billion, and free cash flow was €125 billion. Year-to-date free cash flow stands at -$1.4 billion.