TCL #34: The Green Rush Gathers Steam

From rare earths to recycled batteries, America's clean-tech sector is attracting serious money.

A wave of deals is reshaping America's clean technology sector. Apple has committed $500 million to secure domestic rare-earth supplies. General Motors is turning old electric-vehicle batteries into power systems for data centers. Google has signed up for 3,000 megawatts of hydroelectric power. Across industries, companies are investing heavily in green alternatives.

The pattern is clear. Businesses see money in sustainability. Water treatment firms are being snapped up by private equity. Start-ups developing better batteries and sensors are raising tens of millions in funding. Even traditional manufacturers are finding new uses for waste products. The question is whether these investments will pay off as hoped, or whether the current enthusiasm will prove to have outpaced the technology's readiness for prime time.

To receive these updates in your inbox, subscribe below. The future rarely announces itself, but patterns do.

Rare Earths

Apple has partnered with MP Materials, the only fully integrated rare earth producer in the United States, in a deal worth $500 million. MP Materials will use this investment to expand its factory in Fort Worth, Texas, to supply recycled rare earth magnets. MP's Mountain Pass site facility in California will process recycled rare-earth feedstock from used electronics and post-industrial scrap for reuse in Apple products. Magnet shipments are expected to begin in 2027.

Battery

- Amprius Technologies, a Fremont-based company, has been selected for Amazon's 2025 Devices Climate Tech Accelerator program. The program supports companies developing technologies that could help reduce the carbon footprint of Amazon's devices and operations. As part of the program, Amprius will explore the potential of its SiCore silicon anode batteries, which offer up to 80% higher energy density than conventional lithium-ion batteries, to reduce carbon emissions in Amazon devices.

- General Motors (GM) is collaborating with Redwood Materials to repurpose both new and used electric-vehicle (EV) batteries into energy storage systems. The energy storage systems are intended to power artificial intelligence (AI) data centers and enhance the resilience of the U.S. grid. GM second-life batteries are already being repurposed to power the largest second-life battery development in the world and the largest microgrid in North America, supporting the AI infrastructure company Crusoe. Redwood Materials launched Redwood Energy in June, a new business focused on deploying battery packs into large-scale, low-cost energy-storage systems. This involves utilizing end-of-life EV batteries, many of which retain over 50% of their usable capacity.

Energy

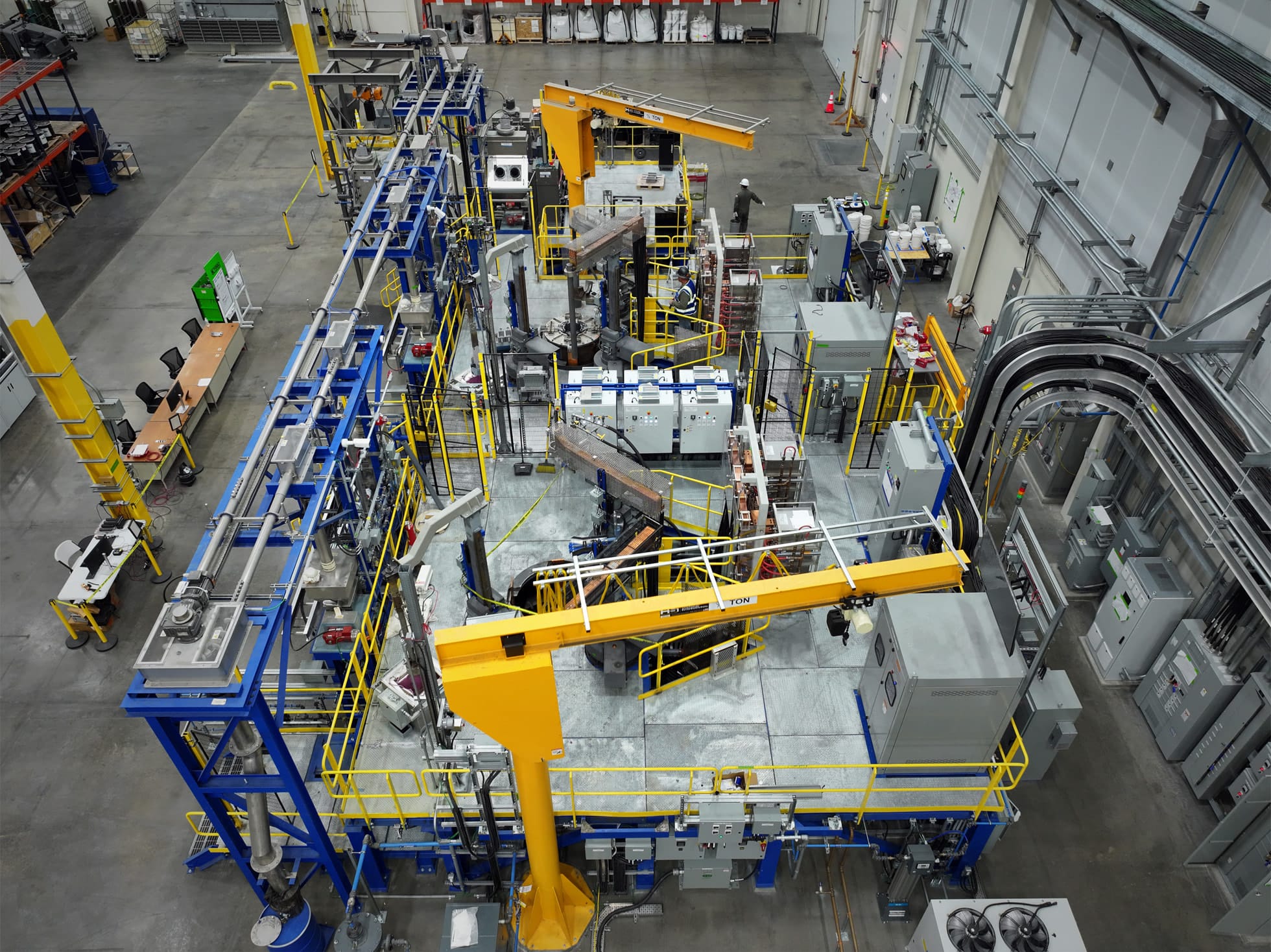

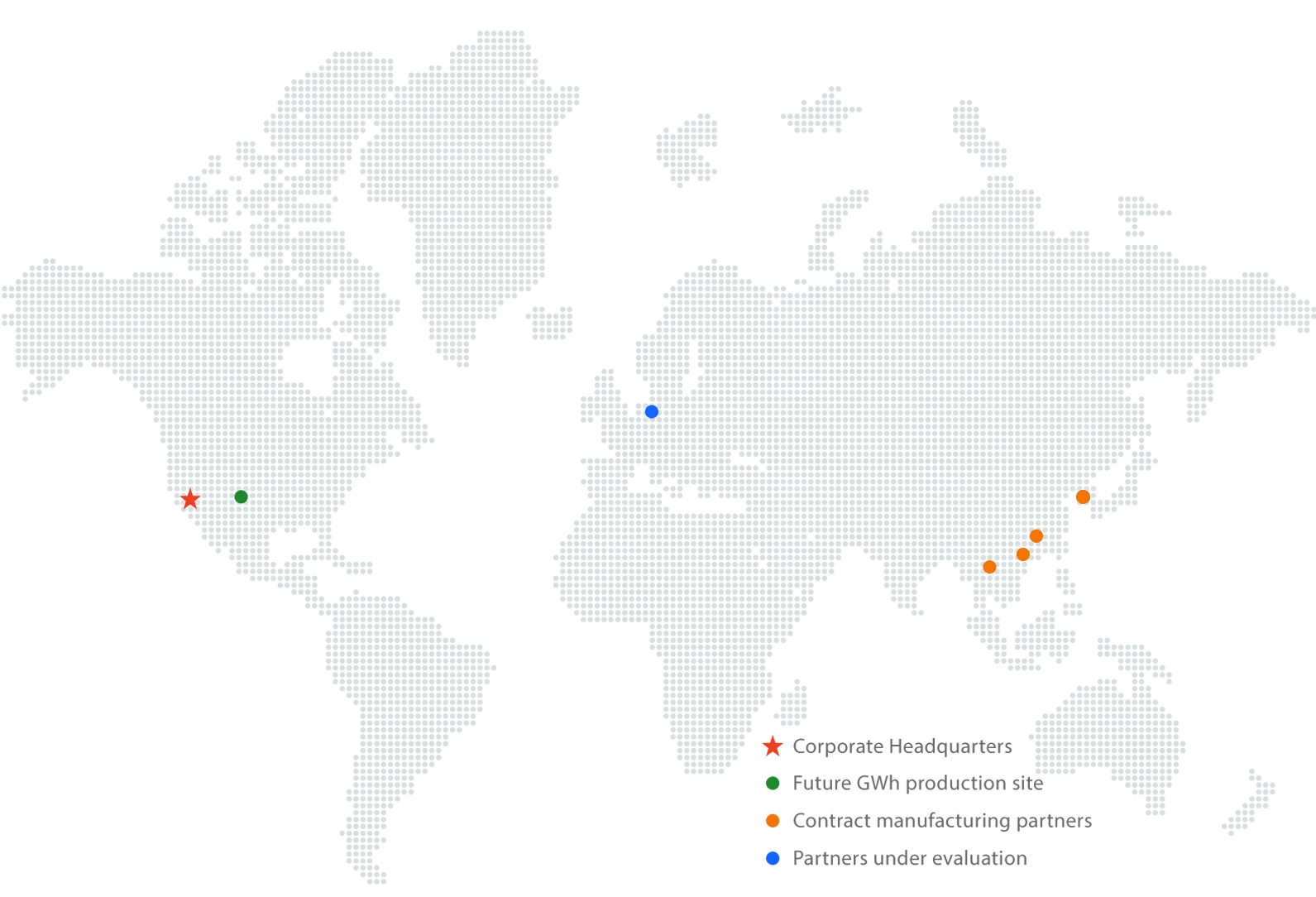

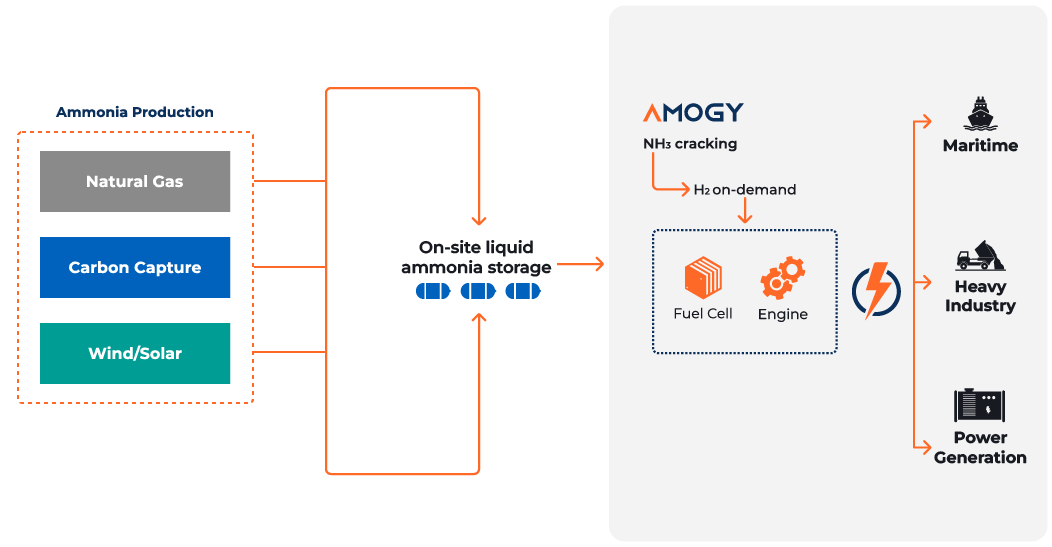

- Amogy has raised an additional $23 million in venture financing, bringing its total funding to nearly $300 million. The company, founded in 2020 and based in Brooklyn, New York, focuses on developing ammonia-based, emission-free, high energy-density power solutions. These solutions aim to decarbonize sectors that are difficult to abate, such as heavy-duty transportation, maritime, and power generation. The additional funding will drive market entry into Asia and scale the company's clean energy solutions.

- Brookfield and Google have signed a Hydro Framework Agreement (HFA) to deliver up to 3000 MW of homegrown hydroelectric energy in the U.S. The first contracts under the HFA are for Brookfield's Holtwood and Safe Harbor hydroelectric facilities in Pennsylvania, totalling $3 billion and 670 MW of capacity. The agreement includes 20-year Power Purchase Agreements (PPA) for the Pennsylvania facilities, supporting Google's operations in the PJM market.

Water Treatment

- Sylmar Group has acquired R2J Chemical Services, Inc., a water treatment solutions provider for industrial, commercial, and institutional clients. The acquisition allows Sylmar Group to enter the Florida market and expand its water treatment operations. R2J has 40 years of experience in industrial water solutions across the Florida market and specialize in cooling and boiler water treatment, Legionella management, potable water solutions, and corrosion control. Sylmar Group, based in Los Angeles, California, focuses on solving water availability and quality challenges by investing in legacy businesses in the water industry. This is Sylmar's first transaction in Florida.

- HKW, a middle-market private equity firm (investing directly into established mid-sized businesses that are neither startups nor large corporations), has acquired Sepratech Liquid Solutions, an industrial water and wastewater treatment service provider headquartered in Gonzales, Louisiana. Sepratech offers services across the Gulf Coast, including clarification, filtration, demineralization, and more.

Manufacturing

H2OK Innovations has raised $12.42 million in Series A funding led by Greysoft, with additional support from 2048 Ventures and Construct Capital. The company is based in Somerville, Massachusetts, and provides AI-powered inline sensors designed to optimize manufacturing processes in the Consumer Packaged Goods (CPG) industry. H2OK's technology ingests 1 million data points per second, providing real-time monitoring that recaptures wasted production time, water, energy, and chemicals. Major clients include Unilever, AB InBev, The Coca-Cola Company, and Danone, with AB InBev planning to scale H2Ok's technology globally.