TCL #27: Quantum Dots Scale Up and Solid-State EV Batteries Advance

Plus: Carbon Removal on Farmland, ChEmpower's Chip Innovation, Aramco-BYD Partnership, and more.

Get The Chem Ledger in your inbox—science, strategy, substance.

Materials

- UbiQD, a company that manufactures low-toxicity quantum dots (QDs) and nanocomposites, has secured $20 million in Series B funding. UbiQD's materials enhance light management across a range of applications, including greenhouse agriculture, solar energy, and advanced security technologies. Post Series B, UbiQD aims to scale manufacturing, expand research and development, and strengthen its intellectual property. UbiQD, based in Los Alamos, New Mexico, aims to create the largest and most efficient quantum dot supply chain globally. UbiQD acquired University of Washington spin-out BlueDot Photonics in February 2025. Notably, just two years earlier, the 2023 Nobel Prize in Chemistry was awarded for the very breakthrough, the discovery and synthesis of quantum dots, that underpins UbiQD's quiet, determined ascent.

- ChEmpower, a semiconductor materials company, has secured $18.7 million in Series A funding to advance abrasive-free planarization in chip manufacturing. ChEmpower's technology aims to improve chip yield and performance while promoting sustainability by reducing water usage in the manufacturing process. The company targets the growing demand for high-performance AI chips, especially as chip feature sizes shrink below 10 nm. ChEmpower has demonstrated its abrasive-free technology with a 300 nm copper platform. The funding will be used to scale manufacturing systems, commercialize products, and recruit talent in various sectors.

- Syensqo and Sinopec have formed a strategic partnership to enhance innovation in sustainable high-value materials. The partnership aims to explore business development opportunities in sectors such as aerospace, transportation, energy, electronics, and industrial applications. Key focus areas include, composites, polymers, and material solutions tailored for commercial aerospace and energy sectors. Both companies will explore business cooperation in emerging markets, particularly in South America and Asia.

Energy

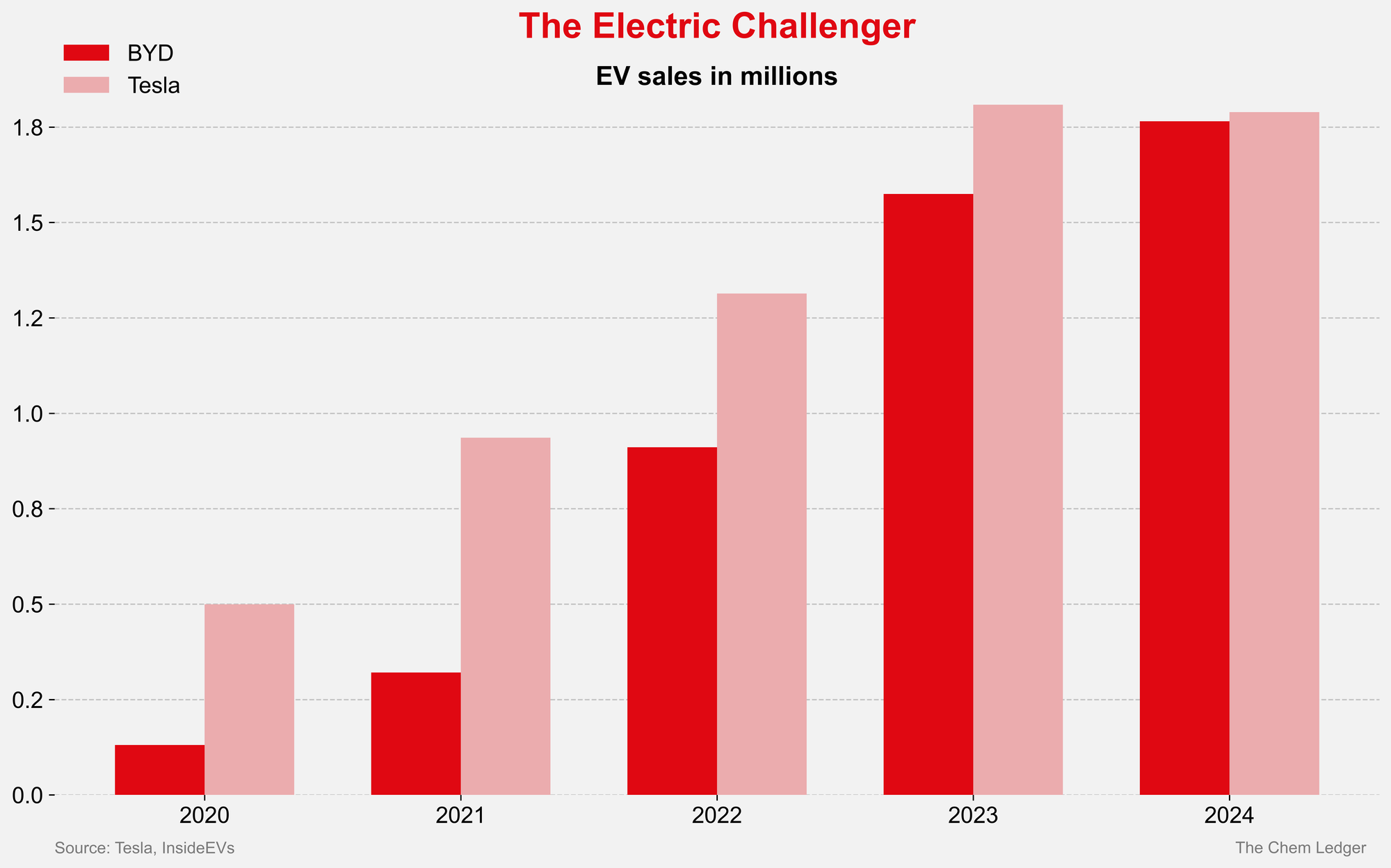

Aramco, through its subsidiary Saudi Aramco Technologies Company (SATC), and BYD signed a joint development agreement to foster the development of technologies in the new energy vehicle sector. The partnership aims to enhance efficiency and environmental performance in the automotive sector.

BYD has rapidly climbed the electric vehicle hierarchy, now challenging established giants and poised at the edge of global EV sales leadership (see chart above). BYD's net profit in the first quarter doubled, reaching $1.26 billion. This profit increase is attributed to strong growth in BYD's electric vehicle (EV) business.

Rare Earths

Cyclic Materials, the Canadian recycler of rare earths, is investing over $20 million in its first U.S. commercial facility in Mesa, Arizona, set to begin operations in early 2026. The facility will process 25,000 tonnes of end-of-life components containing rare earth permanent magnets annually. The company's vision stretches far beyond the confines of the Arizona desert. The company has plans to establish a feedstock supply network across the U.S. with existing partnerships in the Southwest for 155,000 tonnes per year of end-of-life components. This expansion underscores the growing importance of securing a domestic supply of critical materials amid rising demand.

Carbon Capture

Aqualung Carbon Capture, a Norwegian company, has closed the first phase of its 2025 financing round. Aqualung's technology involves a non-pressurized gas separation coated membranes for carbon capture, that passively filter gas molecules. The new funding will allow Aqualung to focus on its thin film coating intellectual property and project development. Phase 2 of the funding round is anticipated to be completed by mid-2025.

Carbon Removal

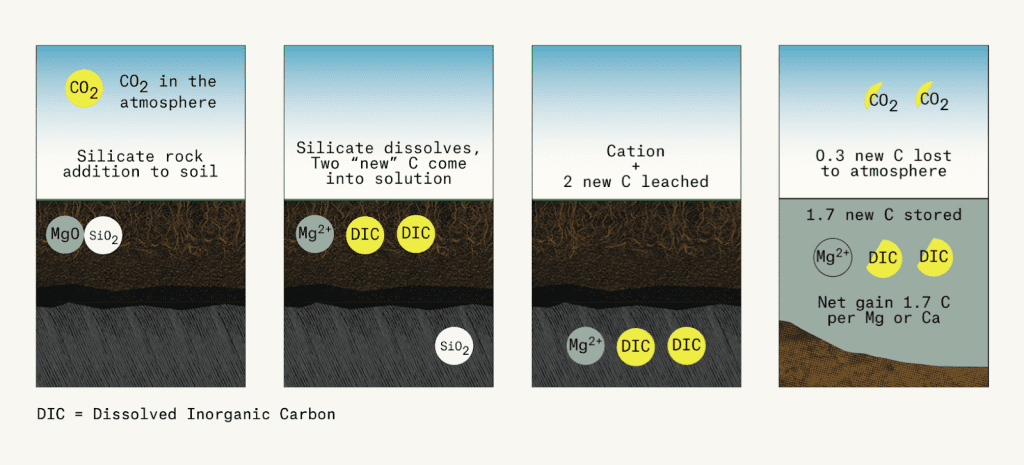

Perdue AgriBusiness and Eion have entered into a carbon removal agreement where Perdue will deploy enhanced rock weathering (ERW) within its supply chain. Perdue grain farmers are expected to remove approximately 3,500 tons of CO2 by applying olivine, a magnesium iron silicate known to naturally sequester carbon dioxide, on farmland in the Mid-Atlantic region. This partnership is an instance of insetting projects which are interventions designed to reduce greenhouse gas emissions within a company's value chain, thus offsetting its carbon footprint.

Battery

Stellantis and Factorial Energy have validated automotive-sized solid-state battery cells with a notable energy density of 375 Wh/kg. Factorial's FEST technology has enabled fast charging from 15% to 90% in 18 minutes. The validated battery cells can function in a temperature range of -30oC to 45oC. High power capabilities are demonstrated with discharge rates up to 4C, supporting the performance demands of EVs. Stellantis plans to incorporate these solid-state batteries into a demonstration fleet by 2026.

Water from Air

AirJoule Technologies has announced a $15 million investment from GE Vernova and other investors to enhance the commercialization of its atmospheric water harvester. The funds will be used to accelerate the production of AirJoule A1000 units which can generate 1,000 to 3,000 liters of water daily. The company's technology efficiently separates water from air using low-grade waste heat, achieving energy consumption of less than 160 watt-hours per liter. This partnership aims to improve energy efficiency and on-site water production for industrial applications like data center and power generation.

Recycling

Asahi Kasei, Nobian, Furuya Metal, and Mastermelt have started a joint project to recycle metals from electrolyzer components. The initiative aims to establish a recycling ecosystem for valuable metals, such as iridium and rubidium, in the chlor-alkali industry.

Biomaterials

Venvirotech, AIMPLAS, and ENPLAST are collaborating on the COM4PHA project which seeks to develop new biodegradable bioplastics. The project focuses on processing bioplastics with conventional technology to create a biodegradable alternative that can compete with traditional plastics. Venvirotech, a biotechnology company specializing in transforming organic waste into bioplastics using proprietary bacteria, is leading the project. AIMPLAS, a Spanish private technology center, is in charge of developing new Polyhydroxyalkanoates (PHA) formulations for packaging production. ENPLAST, a company specializing in the creation and manufacture of all types of plastic packaging will validate the materials developed. The COM4PHA project is funded by the Ministry of Science, Innovation and Universities.

Mining

Barrick Gold is selling its 50% stake in the Donlin gold project in Alaska for up to $1.1. billion. Paulson & Co. and Novagold will acquire 80% and 20%, respectively, of Barrick's interest in Donlin Gold LLC. Proceeds from the sale will be used to strengthen the Canadian miner's balance sheet amid record-high gold prices.

Earnings

3M is maintaining its 2025 earnings guidance despite the impact of tariffs. The company still expects to make between $7.60 and $7.90 per share this year. However, it warns that tariffs could reduce this amount by $0.20 or $0.40 per share. 3M reported a profit of $1.12 billion, or $2.04 per share, exceeding analyst expectations. In the first quarter, adjusted earnings were reported at $1.88 per share, higher than the expected $1.77 per share by analysts.