TCL #26: Oxy Doubles Down on Carbon Capture

Plus: Airbus's $18.5M Hydrogen Bet, Rio Tinto's Green Aluminum Push and more.

Get The Chem Ledger in your inbox—science, strategy, substance.

Carbon Capture

Oxy's and BlackRock's STRATOS, currently under construction in Texas (Video: 1PointFive)

Occidental Petroleum has acquired Holocene Carbon, a direct air capture (DAC) startup based in Knoxville, Tennessee. As Phil De Luna points that, the carbon removal market is becoming more consolidated, with traditional energy companies partnering with carbon tech firms. It also indicates a substantial financial commitment to liquid sorbent technology for carbon capture applications.

Holocene is the second DAC company acquired by Oxy in less than 2 years. Key benefits of the acquisition include Oxy's expertise in deploying carbon capture technology and its involvement with the STRATOS project, a DAC facility under development in Texas. Holocene's early customers include Google, Stripe, and Shopify, which purchase carbon removal credits as part of their strategies to combat climate change and corporate absolution. But this business of atmospheric cleaning still lives or dies by bureaucratic decisions and market whims, the true regulators of all industrial fate.

Hydrogen Production

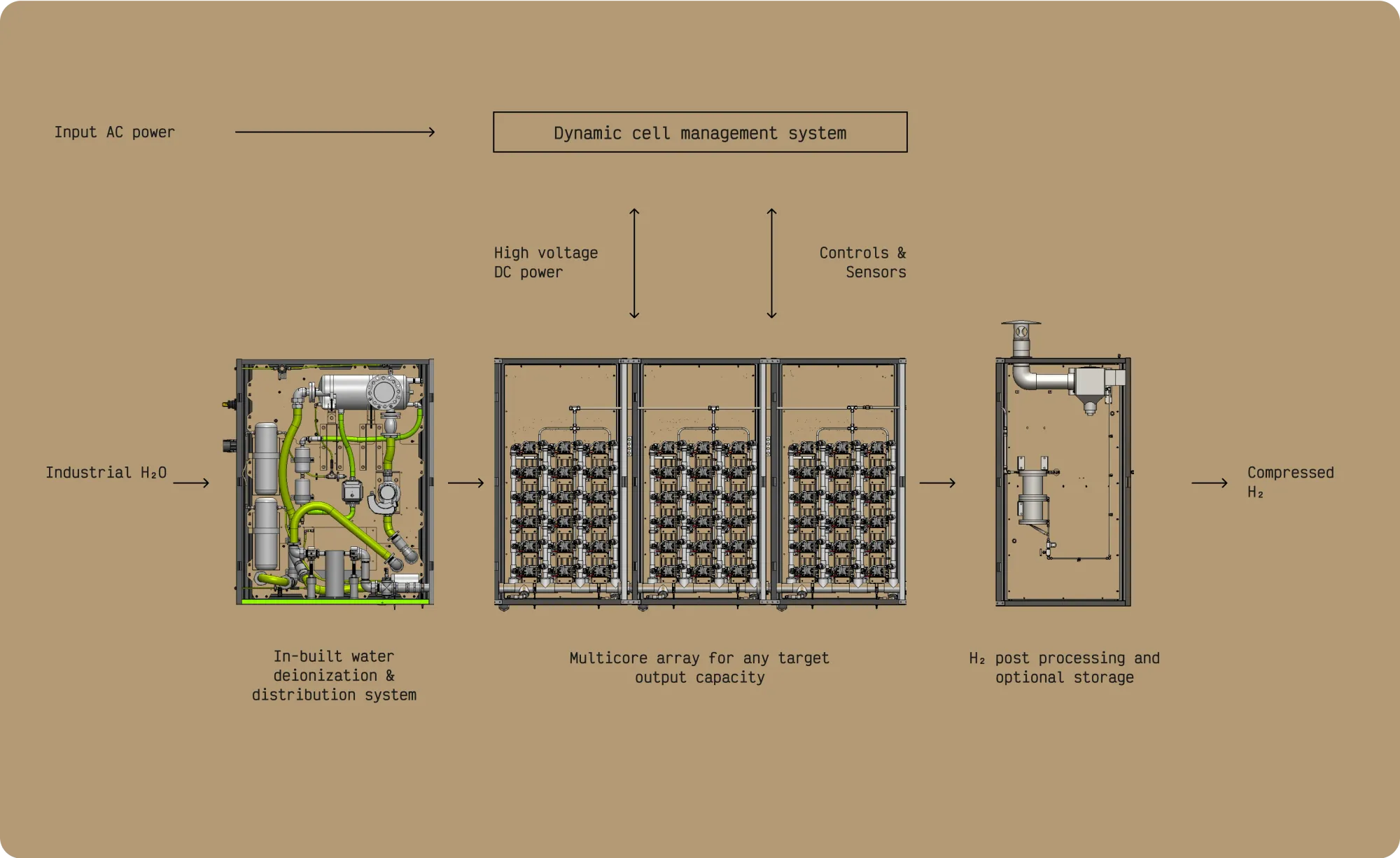

Airbus Ventures has invested in Fourier, a Palo Alto-based on-site hydrogen producer, as part of the company's $18.5 million Series A funding round. The environmental cost of air travel is substantial. Burning fuel, releasing carbon. As global connectivity through flight increases in the coming decades, finding alternatives becomes not just desirable but necessary. As per a report by the International Civil Aviation Organization (ICAO), Sustainable Aviation Fuel (SAF) and low-carbon aviation fuels could contribute to a 56% reduction in net lifecycle CO2 emissions by 2050.

Hydrogen shows promise as a SAF component, but its transportation presents significant obstacles, often multiplying production costs seven to tenfold. Fourier's innovation lies in its on-site, on-demand hydrogen production systems, effectively eliminating the need to transport or store the fuel.

Aluminum

Rio Tinto and AMG Metals & Minerals have signed an MoU to assess a low-carbon aluminum project in India. The project aims to develop an integrated aluminum smelter and alumina production facility powered by renewable energy. The proposed capacity includes up to 1 million tonnes per annum (Mtpa) for primary aluminum and 2 Mtpa for alumina. The energy for the project will come from renewable wind and solar sources, supported by pumped hydro storage. A feasibility study will evaluate the potential for a first phase of 500,000 tonnes per annum of primary aluminum production.

Automation

Seattle startup Potato has secured $4.5 million in funding to enhance automation in scientific research through AI and robotics. The startup plans to advance its technology from computational research to robotics capable of conducting laboratory experiments. Potato collaborates with Gingko Automation to develop automated experimental technologies.

Pharma

- Bristol Myers Squibb's heart medication Camzyos failed in a trail for non-obstructive hypertrophic cardiomyopathy (nHCM), hindering its growth potential. The Phase 3 ODYSSEY-HCM trial followed 580 adult patients for up to 48 weeks. Camzyos, which is used to treat symptomatic obstructive hypertrophic cardiomyopathy, did not meet its primary endpoints for the treatment of nHCM. The findings suggest that obstructive and non-obstructive HCM are distinct diseases requiring different treatment considerations.

- Regeneron Pharmaceuticals has received a priority review from the FDA for its supplemental Biologics License Application (sBLA) for Eylea HD (aflibercept) Injection 8 mg. The sBLA seeks approval for two main indications-

- Treatment of macular edema following retinal vein occlusion (RVO), which is characterised by swelling in the macula, the part of the eye responsible for sharp, central vision.

- Expanded dosing schedule wherein EYLEA HD would be the first treatment for RVO, permitting dosing every 8 weeks after an initial monthly period, reducing the number of injections compared to other anti-vascular endothelial growth factor (VEGF) therapies, reducing treatment burden for patients.

Drug Discovery

PRISM BioLab has partnered with Elix to accelerate AI-driven drug discovery for protein-protein interaction (PPI) targets. PRISM Biolab, based in Fujisawa, Japan, specializes in designing small-molecule inhibitors for challenging protein-protein targets. Elix, based in Tokyo, Japan, applies deep learning and machine learning to improve the drug discovery process for various clients.

Oncology

Mural Oncology, a clinical-stage oncology company focused on discovering and developing immunotherapies for cancer treatment, has announced plans to maximize shareholder value. To achieve this, Mural Oncology is considering options such as a potential sale of the company, a merger, or other transactions. Mural has also announced a workforce reduction of approximately 90% of employees. This decision follows the discontinuation of all clinical development of Nemvaleukin cancer treatment. As of December 2024, Mural had $144.4 million in cash.

Industry & Academia

BASF and the University of Toronto have entered into a Master Research Agreement (MRA), which is the first that BASF has signed with a Canadian University. Five new research projects have been initiated, focusing on areas such as lasso peptide and fungicide synergies for seed treatments and machine learning for solubility prediction. The collaboration will also explore new coatings for architectural materials and drug delivery systems for medical applications.

Earnings

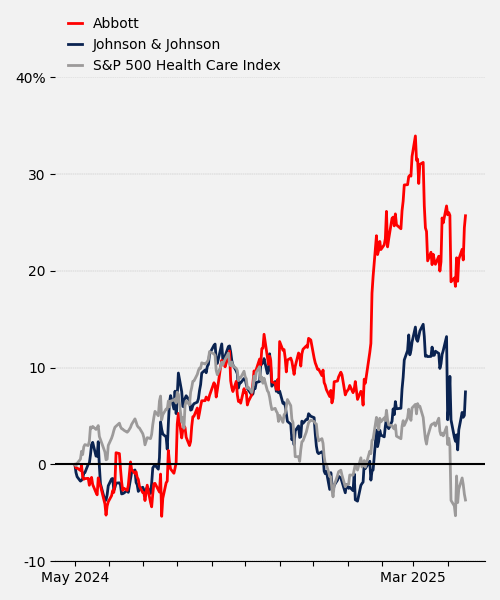

Johnson & Johnson (J&J) had a solid first quarter in 2025 and has increased its sales outlook for the year. Total sales were up 2.4% from last year to $21.9 billion. Adjusted earnings per share were up 2.2% from last year to $2.77. The company has increased its quarterly dividend by 4.8%, raising it from $1.24 to $1.30. This marks the 63rd consecutive year that J&J has raised its dividend payout, which ensures J&J's continuous inclusion in the S&P 500 Dividend Aristocrats Index. This index comprises 69 companies that have raised dividends for at least 25 consecutive years. Despite the positive outlook, J&J anticipates a $400 million impact from ongoing tariffs, primarily affected by its medtech division.

Abbott shares rose 6% to $133.8 following the earnings report on April 16, 2025. The company reported a profit of $1.33 billion for the first quarter, an increase from $1.23 billion the previous year. Adjusted earnings were reported at $1.09 per share, slightly above analyst expectations. Revenue for the quarter grew by 4% to $10.36 billion. Sales in pediatric and adult nutrition grew by 3.2% and 4.4%, respectively, driven by the success of brands like Glucerna and Ensure. Worldwide medical device sales increase nearly 10%, particularly in diabetes care and heart-related categories. Sales in Abbott's global diagnostics sales dropped by 7.2%, but were slightly higher if you exclude COVID-19 testing products. Core laboratory diagnostics sales dropped by about 2.3%, which Abbott said was due to cost-cutting programs in China for drugs and medical devices.