TCL #22: Aramco Backs Carbon Capture, $6.7B Pharma Merger, Germany’s Biggest Green Hydrogen Deal

Plus, $200M for AI-Powered Scientific Discovery, and Major Investments in Plastic Recycling Technologies.

Get chemical industry insights in your mailbox. No fluff, just facts.

Carbon Capture

Aramco Ventures, the investment arm of Saudi Aramco, has invested in Ucaneo, a Berlin-based startup focused on direct air capture (DAC) technology to remove carbon dioxide from the atmosphere. Ucaneo's DAC technology dissolves CO2 as bicarbonates leveraging biocatalysts and electrochemistry to efficiently remove CO2 at room temperature without forming strong covalent bonds. Ucaneo has launched its first industrial pilot capable of capturing 30-50 tons of CO2 annually, marking it one of the largest DAC pilots in Germany. The investment by Aramco Ventures will expedite Ucaneo's plans for the demonstration plant, expected to be commissioned in the first half of 2026. Ucaneo projects that its DAC technology will cost less than €300 (approximately $324.90) per ton of CO₂.

Climate Action

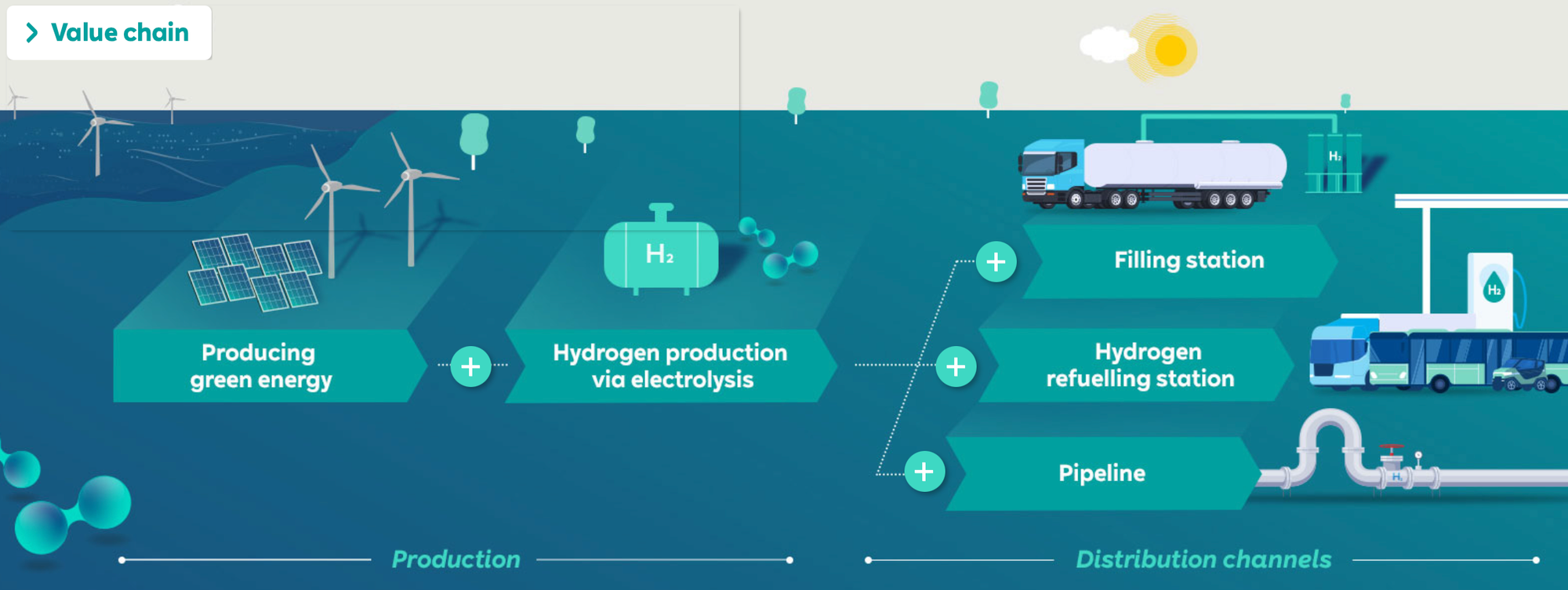

TotalEnergies and RWE have partnered to decarbonize the Leuna refinery in Germany. RWE will supply 30,000 metric tons of green hydrogen annually to TotalEnergies' Leuna refinery for 15 years, starting in 2030. This represents the largest contracted green hydrogen supply from a German electrolysis facility. The green hydrogen will be produced by a 300 MW electrolyzer built and operated by RWE in Lingen. The project is expected to prevent approximately 300,000 tons of CO2 emissions annually at the Leuna refinery.

Recycling

- Xycle has secured funding for its first commercial-scale chemical recycling plant in Rotterdam, The Netherlands, supported by Dow, ING, Invest-NL, Polestar Capital, and Vopak. Xcyle's technology utilizes low-temperature pyrolysis to efficiently recycle difficult-to-recycle plastics into pyrolysis oil, which can be used as feedstock for new plastic production. The facility in Rotterdam will process 21,000 metric tons of plastic waste annually. The plant is expected to be operational by Q4 2026, with a modular design that allows for scalable production based on demand.

- Circ has closed a $25 million oversubscribed funding round led by Taranis through its Carbon Ventures fund, aimed at enhancing textile-to-textile recycling on an industrial scale. Circ specializes in recycling polycotton blends. The partnership with Taranis is expected to bring engineering and operational proficiency to expand Circ's recycling technology worldwide.

- OMV has secured €81.6 million (approximately $88.9 million) in EU funding for its planned industrial ReOil plant. This marks the first time OMV has received a grant from the EU Innovation Fund, which will support the construction of a large-scale chemical recycling plant designed to process up to 200,000 metric tons of waste plastics.

Industrial Technology

Aloxy, an Internet of Things (IoT) company based in Antwerp, Belgium, has secured €7.4 million (approximately $8 million) in funding. The funding came from Dow Venture Capital, Emerson Ventures, and other existing investors. Aloxy intends to use the capital to build IIoT (Industrial Internet of Things) solutions for the energy and chemical industry. The company was founded as a spin-off from the University of Antwerp. Its technology includes wireless sensors that track the status of manual valves, emergency showers, and line blinds, enhancing operational safety and efficiency.

Petrochemicals

ABB has partnered with Dow for the Path2Zero project at Fort Saskatchewan in Alberta, Canada. The Path2Zero project is Dow's initiative to construct the world's first net-zero emissions integrated ethylene cracker and derivatives site. The $6.5 billion project aims to achieve net-zero Scope 1 and Scope 2 emissions by retrofitting the site's existing cracker and building a new ethylene cracker, increasing polyethylene capacity by 2 million metric tonnes per annum (MTA). As the automation partner, ABB will provide automation solutions aimed at enhancing energy efficiency, automating processes, and optimising operations at the facility.

Fabrication

ATLANT 3D, a Danish company focused on atomic-scale manufacturing technology, has secured $15 million in a Series A+ funding round. West Hill Capital led the funding round, marking their second time leading a funding round for ATLANT 3D, having also led their Series A round in September 2022. The total funding raised to date is $49.7 million. The company's technology enables the precise development of advanced materials for various applications, including optics, photonics, microelectronics, and quantum computing.

Additive Manufacturing

Alloyed, a UK-based alloy design firm and Oxford University spin-out, has raised £37 million (around $48 million) in a Series B funding round. The funding will support Alloyed's expansion in both the UK and the USA. Plans include enhancing research and development (R&D) and production capabilities at their sites in Abingdon, UK, and Seattle, USA.

Specialty Chemicals

Scimplify, a B2B fulfilment platform and CDMO for specialty chemicals, has raised $40 million in a Series B funding round. The funding was co-led by Accel and Bertelsmann India Investments, with participation from UMI and existing investors including Omnivore and 3one4 Capital. This brings Scimplify's total funding to $54 million, following $13.5 million raised across seed and Series A rounds. The funding will be used to scale its platform, expand its presence in the U.S, enter new markets, increase international sales, and boost its R&D capabilities.

Pharma

- Johnson & Johnson (J&J) and Legend Biotech are investing $150 million to expand Legend's cell therapy facility, called Tech Lane, in Belgium. The facility in Ghent, Belgium, will support clinical supply as more patients gain access to the CAR-T therapy Carvykti. The investment aims to expand Carvykti manufacturing in Europe and to double Carvykti production. This expansion intends to address supply constraints and rising demand.

- Mallinckrodt Pharmaceuticals and Endo have agreed to merge in a deal valued at $6.7 billion in cash and stock. Endo shareholders will receive in $80 million in cash and own 49.9% of the combined company, while Mallinckrodt shareholders will own the remaining portion. The combined company is projected to generate $3.6 billion in revenue in 2025. The deal is expected to close in the second quarter of 2025. The post-merger company will be listed on the NYSE. Mallinckrodt is a global specialty pharmaceutical company that develops, manufactures, and distributes treatments for underserved patient populations while Endo is a pharmaceutical company innovating in endocrinology, urology, orthopaedics, and retail generic medications The merger aims to broaden patient access and develop new therapies for unmet medical needs.

- Insilico Medicine has secured $110 million in Series E financing. The funding will be utilized to further develop AI-driven drug discovery technologies. Insilico uses genomics, big data analysis, and deep learning for in-silico drug discovery. The Series E round places the company's valuation at over $1 billion.

- Bristol Myers Squibb has received expanded approval from the European Commission for its CAR-T cell therapy Breyanzi. The approval expands the use of Breyanzi for relapsed or refractory follicular lymphoma. This approval was based on data from a Phase II study that showed a 94.2% complete response rate.

Life Sciences

Lila Sciences, founded in 2023 within Flagship Pioneering's labs, has secured $200 million in seed funding. Lila was launched to develop an AI-based platform designed to automate scientific discovery. Lila aims to offer

- Scientific superintelligence platform and autonomous labs for life, chemical, and materials sciences.

- AI platform that, with human guidance, scales and optimizes experimentation in any scientific domain by combining generative AI with autonomous labs.

- Generative AI trained with research papers, documented experiments, and data from its labs.

Industry & Academia

H.E.L. Group, a UK-based manufacturer of scientific instruments and software, has signed a three-year research agreement with the Institute of Chemical Technology (ICT) Mumbai. The collaboration aims to enhance process safety in chemical synthesis through calorimetry, promoting innovation and education. H.E.L. will provide ICT with a Simular Process Development Reaction Calorimeter. The calorimeter will enable the optimization of process conditions and the determination of safe operational parameters.

Manufacturing

Infinite Uptime, an Indian startup providing predictive maintenance solutions for factories, has raised $35 million in a Series C funding round. The funding will be used to expand its AI-powered predictive maintenance solutions, scale its IoT platform, and grow its global presence. The Series C funding round was led by Avataar Ventures.