TCL #41: AI-Driven Chemistry, Nuclear Operations, and Carbon Management Shape the Future

A comprehensive look at this week's major developments spanning artificial intelligence applications, nuclear technology advances, and breakthrough funding across materials, biotechnology, and clean energy sectors.

The convergence of artificial intelligence with traditional industries continues to accelerate, as evidenced by this week's significant funding announcements and strategic partnerships. From CuspAI's $100 million Series A round focused on chemistry applications to Nuclearn's AI solutions for nuclear operations, we're witnessing a fundamental shift in how established sectors embrace technological transformation. Meanwhile, substantial investments in carbon capture technologies, nuclear reactor development, and advanced materials signal growing confidence in next-generation solutions to global challenges.

Materials

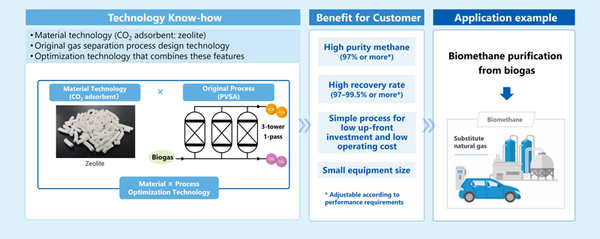

Technip Energies has entered into a definitive agreement to acquire Ecovyst's Advanced Materials & Catalysts business for $556 million. The deal represents an EBITDA multiple of approximately 9.8. Ecovyst's Advanced Materials & Catalysts business comprises of Advanced Silicas and Zeolyst International, which is a 50:50 joint venture with Shell Catalysts &U Technologies, and a supplier of custom zeolite-based materials for hydrocracking, sustainable fuels and custom catalyst applications. The transaction will likely close by the first quarter of 2026.

Artificial Intelligence (AI)

- CuspAI, a startup developing AI models for chemistry, has raised $100 million in Series A funding, valuing the company at $520 million. The funding round was led by New Enterprise Associates and Temasek, with participation from Nvidia, Samsung Ventures, and Hyundai Motor Group. Hyundai is partnering with CuspAI on sustainable energy applications, aiming to leverage AI for performance and sustainability goals. Last month, CuspAI and Meta, along with the Georgia Institute of Technology, released the Open Direct Air Capture 2025 (ODAC25) dataset, which is recognized as the largest open dataset available for identifying materials capable of capturing CO2 from the air.

- Nuclearn, a company focused on developing AI solutions for nuclear operations, has raised $10.5 million in Series A funding round. Nuclearn's first product automates corrective action program screening, reducing weeks of manual work to minutes while maintaining traceability. The company's solutions also include outage planning, regulatory documentation, supply chain forecasting, and more. With this funding, Nuclearn plans to advance product development, grow its workforce, and expand its market reach.

Nuclear Tech

Deep Fission, a nuclear energy company, has gone public through a reverse merger transaction and a $30 million private placement offering at $3 per share. The company aims to deploy its first underground reactor by 2026 as part of the U.S. Department of Energy's Reactor Pilot Program. The first commercial project targets a cost of 5-7 cents per kWh.

Manufacturing

Clariant has entered into a supply agreement with SYPOX to provide catalysts for the world's largest electric steam methane reformer (e-SMR). The e-SMR is planned to produce 150 tons of syngas daily using 10 MW of renewable electricity. The commercial operation of the e-SMR is scheduled to begin in 2026, reducing emissions by up to 40%.

Carbon Capture

The Canadian government has announced an investment of $5.8 million to support three companies in British Columbia that are developing carbon management technology. Specific allocations include $1.3 million to Svante to improve testing infrastructure by setting up a new facility, $2 million to Anodyne Chemistries Inc. for demonstrating and expanding industrial processes that create products such as formate, and $2.4 million to Agora Energy Technologies Ltd to advance processes for capturing and utilizing CO2 from impure flue gas.

Biotech

- Cascade Bio has secured $6 million in funding to advance its cell-free biomanufacturing processes and biocatalysts. The funding aims to accelerate the company's transition from petrochemical processes to enzyme-based methods.

- Evonik and Ethris have entered into a strategic partnership to expand their offerings for nucleic acid delivery. Evonik will expand its formulation development services using Ethris' proprietary lipidoid nanoparticle technology. This partnership will aid Evonik in assisting pharmaceutical companies in developing more stable and targeted nucleic acid therapies and vaccines, integrating products, technologies, and services from concept to final production.

Agriculture

Nutrien has agreed to sell its 50%equity stake in Profertil, an Argentina-based nitrogen producer, to Adecoagro S.A. and Asociacion de Cooperativas Argentinas Coop Ltda. The sale is expected to generate approximately $600 million on a pre-tax basis. Proceeds from the sale will be used for targeted growth investments, share repurchases, and debt reduction. The deal, subject to customary closing conditions, is expected to close by the end of 2025.

Drug Discovery

NRG Therapeutics has raised £50 million (~ $67 million ) in a Series B financing round. This funding will be used to advance their lead compound, NRG5051, into clinical trials for Parkinson's disease and to achieve proof-of-concept in Amyotrophic Lateral Sclerosis (ALS)/Motor Neuron Disease (MND).